Leave a Legacy:

Will or Trust

You can gift an asset, provide a dollar amount, leave a percentage of your estate, or have Barrow Neurological Foundation be a contingent beneficiary of your estate.

Gift Your Will or Trust

What will be your legacy? When Charles Barrow decided to give his name and $500,000 to create Barrow Neurological Institute, he did it in honor of the outstanding care that his wife had received from the surgeons, doctors, nurses, and staff members after she was diagnosed with a malignant brain tumor. He believed that Arizona could become a destination and hub for neuroscience.

More than 60 years later, his legacy continues on at Barrow Neurological Institute through the physicians and researchers who work tirelessly every day to find treatments for neurological diseases and disorders, train the next generation of neuroscience specialists, and provide compassionate care for patients. As you think about your estate planning, consider leaving a legacy gift to Barrow Neurological Foundation in your will or trust to make a meaningful impact for years to come.

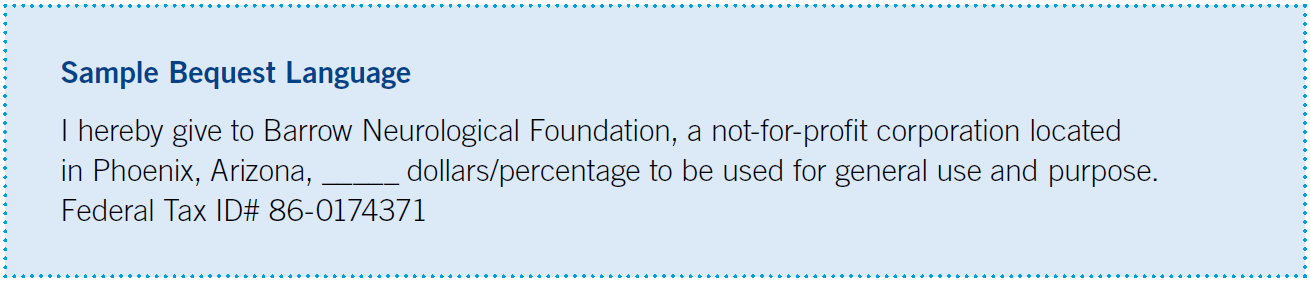

Sample Bequest Language

I hereby give to Barrow Neurological Foundation, a not-for-profit corporation located

in Phoenix, Arizona, ________ dollars/percentage to be used for general use and purpose.

Federal Tax ID# 86-0174371

Learn more about maximizing your gift!

Emily Lawson, Senior Director of Philanthropy

[email protected] | 602.406.1051

Hear from Mike and Sandy Hecomovich

They recently created a lasting legacy at Barrow with a planned gift.

We are proud to be a part of the Barrow Legacy Society. As longtime partners of Barrow, it gives us such a sense of fulfillment knowing that part of our estate will go towards ensuring that world-class care, research, and education at Barrow continue well into the future.

[Name Title]

Mike Hecomovich, Chair of the Barrow Neurological Foundation Board of Trustees, and Sandy Hecomovich, Past Chairman of the Barrow Women’s Board, have devoted their time and treasure to supporting Barrow’s mission of changing and saving lives.

Barrow Planned Giving Options

There are numerous ways to leave a lasting legacy at Barrow. Check out our giving options to identify the opportunity that best fits your financial and charitable goals.

As you think about your estate planning, consider leaving a legacy gift to Barrow Neurological Foundation in your will or trust to make a meaningful impact for years to come.

Retirement accounts often are the best assets to donate to charitable organizations, such as Barrow Neurological Foundation, during your lifetime and in your legacy.

A donor advised fund (DAF) is a “charitable savings account” that allows you to receive a deduction the year you need it most and give to charities and causes that are meaningful to you over time.

Create an income for life and a legacy that supports research, patient care, and education at Barrow.

There are many ways to gift life insurance and investment annuities.

Appreciated assets, including real estate, rental property, vacation homes, business assets, and business interests, are great ways to give to Barrow Neurological Foundation.

If you transfer stock to Barrow Neurological Foundation, we will be able to sell the stock tax free, allowing you to avoid any capital gains tax you would otherwise have to pay.

The information provided is not intended as legal or tax advice. For such advice, please consult an attorney, financial or tax advisor.