Leave a Legacy:

Donor-Advised Fund

Receive a deduction the year you need it most and give to charities and causes that are meaningful to you over time.

Gift a Donor-Advised Fund

A donor-advised fund (DAF) is a “charitable savings account” that allows you to receive a deduction the year you need it most and give to charities and causes that are meaningful to you over time. When you set up a DAF at a community foundation or financial institution, you have the ability to choose from a variety of charities, such as Barrow Neurological Foundation, to support each year.

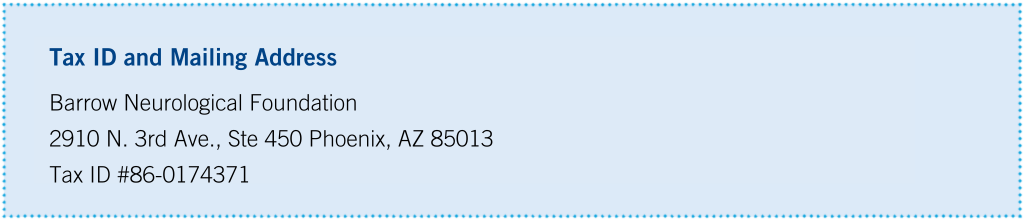

Simply contact the community foundation or financial institution with the Foundation’s Tax ID and mailing address:

Tax ID and Mailing Address

Barrow Neurological Foundation

2910 N. 3rd Ave., Ste 450 Phoenix, AZ 85013

Tax ID #86-0174371

Learn more about maximizing your gift!

Emily Lawson, Senior Director of Philanthropy

[email protected] | 602.406.1051

Common ways DAFs are used:

As a tax-planning vehicle

Selling complicated assets in a tax-advantaged manner

Accounting for charitable contributions

Teaching philanthropy to future generations.

Barrow Planned Giving Options

As you think about your estate planning, consider leaving a legacy gift to Barrow Neurological Foundation in your will or trust to make a meaningful impact for years to come.

Retirement accounts often are the best assets to donate to charitable organizations, such as Barrow Neurological Foundation, during your lifetime and in your legacy.

A donor advised fund (DAF) is a “charitable savings account” that allows you to receive a deduction the year you need it most and give to charities and causes that are meaningful to you over time.

Create an income for life and a legacy that supports research, patient care, and education at Barrow.

There are many ways to gift life insurance and investment annuities.

Appreciated assets, including real estate, rental property, vacation homes, business assets, and business interests, are great ways to give to Barrow Neurological Foundation.

If you transfer stock to Barrow Neurological Foundation, we will be able to sell the stock tax free, allowing you to avoid any capital gains tax you would otherwise have to pay.

The information provided is not intended as legal or tax advice. For such advice, please consult an attorney, financial or tax advisor.